Things about Estate Planning Attorney

The Ultimate Guide To Estate Planning Attorney

Table of ContentsOur Estate Planning Attorney Diaries9 Simple Techniques For Estate Planning AttorneyEverything about Estate Planning AttorneyEstate Planning Attorney Things To Know Before You Buy

Your lawyer will certainly additionally help you make your papers authorities, preparing for witnesses and notary public trademarks as essential, so you do not need to fret regarding trying to do that final step on your own - Estate Planning Attorney. Last, yet not least, there is useful assurance in establishing a connection with an estate planning attorney that can be there for you down the roadBasically, estate preparation lawyers offer worth in lots of methods, far past merely providing you with published wills, trusts, or various other estate preparing files. If you have inquiries concerning the process and wish to find out more, contact our workplace today.

An estate planning lawyer helps you define end-of-life choices and legal files. They can set up wills, develop counts on, develop wellness treatment directives, establish power of lawyer, produce sequence plans, and more, according to your desires. Working with an estate preparation attorney to finish and oversee this lawful paperwork can assist you in the following 8 areas: Estate intending attorneys are professionals in your state's trust, probate, and tax laws.

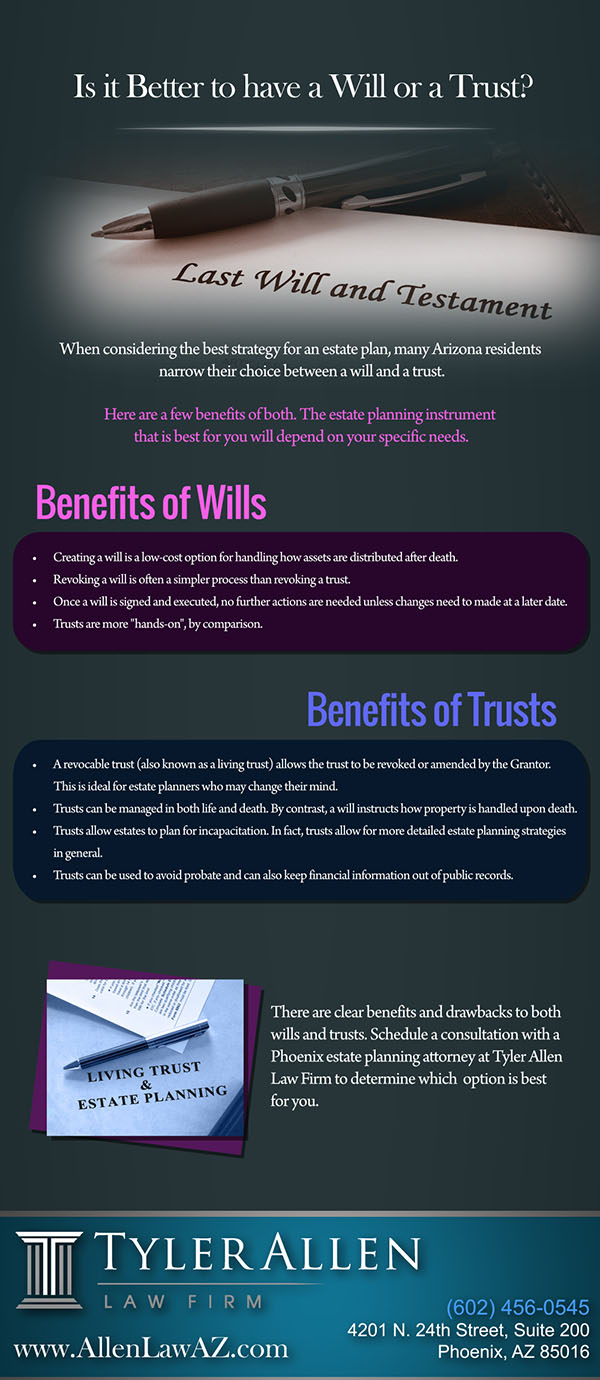

If you do not have a will, the state can decide how to split your possessions amongst your heirs, which might not be according to your desires. An estate preparation lawyer can aid organize all your legal papers and disperse your assets as you wish, potentially preventing probate.

Fascination About Estate Planning Attorney

Once a customer dies, an estate strategy would dictate the dispersal of assets per the deceased's directions. Estate Planning Attorney. Without an estate plan, these choices may be delegated the following of kin or the state. Tasks of estate coordinators include: Creating a last will and testimony Setting up count on accounts Naming an administrator and power of lawyers Determining all beneficiaries Naming a guardian for minor kids Paying all financial obligations and lessening all taxes and lawful costs Crafting directions for passing your worths Developing preferences for funeral setups Settling directions for care if you come to be ill and are unable to choose Acquiring life insurance coverage, special needs income insurance, and long-term care insurance An excellent estate plan should be updated on a regular basis as customers' financial scenarios, personal motivations, and government and state legislations all develop

As with any kind of occupation, there are qualities and abilities that can assist you attain these goals as you deal with your clients in an estate organizer role. An estate preparation career can be ideal for you if you have the complying with traits: Being an estate coordinator means believing in the long-term.

Examine This Report on Estate Planning Attorney

You should assist visit our website your client expect his/her end of life and what will certainly occur postmortem, while at the exact same time not house on somber ideas or emotions. Some clients may come to be bitter or troubled when considering fatality and it might fall to you to assist them through it.

In case of fatality, you might be expected to have many conversations and transactions with surviving relative regarding the estate plan. In order to excel as an estate organizer, you might need to stroll a great line of being a shoulder to lean on and the individual counted on to connect estate preparation matters in a prompt and specialist way.

tax obligation code changed countless times in the 10 years between 2001 and 2012. Anticipate that it has been changed better ever since. Depending on your client's economic income brace, which might develop towards end-of-life, you as an estate organizer will certainly need to keep your client's possessions completely legal compliance with any type of local, federal, or global tax obligation regulations.

Not known Factual Statements About Estate Planning Attorney

Getting this accreditation from companies like the National Institute of Licensed Estate Planners, Inc. can be a strong differentiator. Belonging to these professional teams can verify your skills, making you more eye-catching in the eyes of a possible customer. Along with the emotional incentive helpful clients with end-of-life planning, estate organizers appreciate the benefits of a stable revenue.

Estate preparation is a smart thing to do regardless of your current health and economic status. The very first essential point is to hire an estate preparation lawyer to assist you with it.

The percentage of individuals who do not know exactly how to get a will has boosted from 4% to 7.6% considering that 2017. A skilled lawyer knows what info to consist of in the will, including your beneficiaries and special factors to consider. A will shields your family from loss due to the fact that of immaturity or disqualification. It likewise supplies the swiftest and most effective technique to move your assets to your beneficiaries.